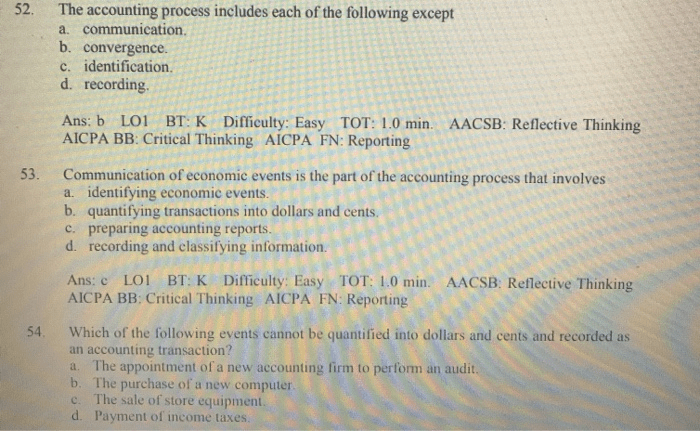

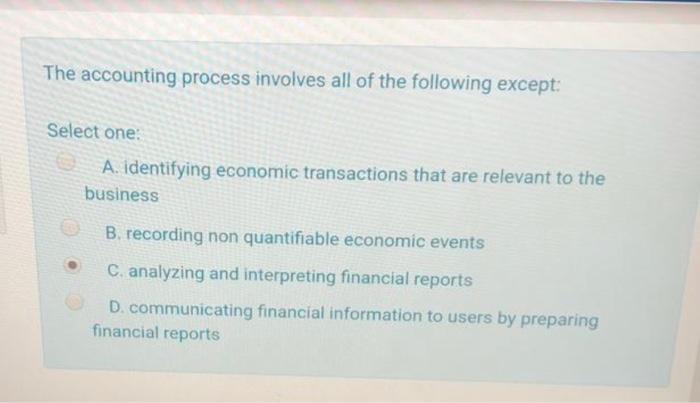

The accounting process involves all of the following except non-financial transactions, which are not recorded in accounting records. This exclusion is crucial for maintaining the accuracy and integrity of financial statements, ensuring they accurately reflect an entity’s financial position and performance.

The accounting process encompasses a series of steps, including recording, classifying, summarizing, and reporting financial transactions. However, certain items are intentionally excluded from this process, as they do not meet the criteria for financial transactions.

1. Understanding the Accounting Process

The accounting process involves the systematic recording, classifying, summarizing, and reporting of financial transactions to provide information that is useful for decision-making.

The accounting process consists of the following steps:

- Identifying and recording financial transactions

- Classifying transactions into different accounts

- Summarizing transactions in the form of financial statements

- Reporting financial statements to users

The purpose of accounting records is to provide a complete and accurate record of all financial transactions of an organization. These records are used to prepare financial statements, which are used by investors, creditors, and other stakeholders to make informed decisions about the organization.

2. Exclusions from the Accounting Process

The accounting process does not include all financial transactions. Some transactions are excluded from the accounting process because they do not meet the criteria for recognition as an asset, liability, revenue, or expense.

The following items are typically excluded from the accounting process:

- Transactions that do not have a monetary value

- Transactions that are not considered to be material

- Transactions that are not considered to be relevant to the financial statements

For example, the purchase of a pencil would not be recorded in the accounting records because it does not have a monetary value. The purchase of a new building, on the other hand, would be recorded in the accounting records because it is a material transaction that is relevant to the financial statements.

3. Impact of Excluded Items on Financial Statements: The Accounting Process Involves All Of The Following Except

The exclusion of certain items from the accounting process can have a significant impact on financial statements. For example, the exclusion of a large expense could make the organization appear more profitable than it actually is. The exclusion of a large asset could make the organization appear less financially stable than it actually is.

It is important to disclose excluded items in financial statements. This disclosure allows users of the financial statements to understand the limitations of the financial statements and to make informed decisions about the organization.

Excluded items can be presented in financial statements in a variety of ways. For example, excluded items can be disclosed in the notes to the financial statements or in a separate schedule.

4. Ethical Considerations in Accounting

There are a number of ethical considerations related to the exclusion of items from the accounting process. For example, accountants have a responsibility to ensure that the financial statements are accurate and complete. Accountants also have a responsibility to avoid conflicts of interest.

The exclusion of items from the accounting process can have a significant impact on the financial statements. It is important for accountants to be aware of the ethical considerations related to the exclusion of items from the accounting process and to make sure that they are acting in the best interests of the organization and its stakeholders.

5. Case Studies and Real-World Examples

There are a number of case studies and real-world examples of how the exclusion of items from the accounting process can impact financial statements. For example, the Enron scandal was caused, in part, by the exclusion of certain liabilities from the accounting records.

Another example is the case of WorldCom. WorldCom excluded certain expenses from its accounting records, which made the company appear more profitable than it actually was. This led to a loss of investor confidence and the eventual collapse of the company.

These case studies and real-world examples show that the exclusion of items from the accounting process can have a significant impact on financial statements. It is important for accountants to be aware of the ethical considerations related to the exclusion of items from the accounting process and to make sure that they are acting in the best interests of the organization and its stakeholders.

FAQ Corner

What are non-financial transactions?

Non-financial transactions are events or activities that do not have a direct financial impact on an entity. They do not involve the exchange of cash, assets, or liabilities and, therefore, are not recorded in accounting records.

Why are non-financial transactions excluded from the accounting process?

Non-financial transactions are excluded because they do not meet the criteria for financial transactions, which require measurability in monetary terms and relevance to the financial position or performance of an entity.

What are some examples of non-financial transactions?

Examples of non-financial transactions include changes in ownership structure, mergers and acquisitions, and the issuance of stock dividends.