H&r block tax knowledge assessment test- answers – Embark on a comprehensive exploration of the H&R Block Tax Knowledge Assessment Test answers, a pivotal resource for tax professionals seeking to enhance their expertise. This guide unveils the intricacies of the test, empowering you with the knowledge and strategies to excel in the field of taxation.

Within this meticulously crafted document, you will uncover a detailed analysis of answer choices, unraveling the reasoning behind each option and dispelling common misconceptions. Moreover, sample questions and solutions are presented in an interactive table, providing a practical understanding of the test format and difficulty levels.

Introduction to H&R Block Tax Knowledge Assessment Test

The H&R Block Tax Knowledge Assessment Test is an online assessment designed to evaluate an individual’s understanding of tax concepts and principles. It is typically used by H&R Block, a leading tax preparation company, to assess the tax knowledge of potential employees and to identify candidates who have the necessary skills and qualifications for tax-related roles.

The test is designed for individuals who have a basic understanding of tax principles and who are seeking employment in the tax field. It covers a wide range of tax topics, including individual income tax, business tax, and tax planning.

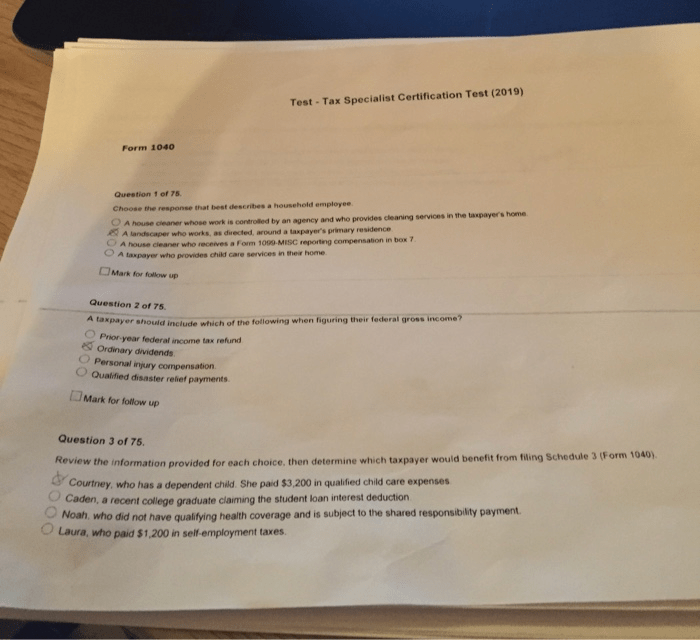

The test consists of multiple-choice questions and is typically administered online. The questions are designed to test the candidate’s knowledge of tax laws, regulations, and accounting principles.

Analyzing Answer Choices

The H&R Block Tax Knowledge Assessment Test provides multiple answer choices for each question. It is important to carefully analyze each answer choice before selecting the best answer. Here are some tips for analyzing answer choices:

- Read the question carefully and identify the key concepts being tested.

- Read each answer choice carefully and identify the main points being made.

- Eliminate any answer choices that are clearly incorrect or irrelevant.

- Consider the context of the question and the overall topic being tested.

- Look for answer choices that are specific and provide detailed information.

Common Mistakes or Misconceptions, H&r block tax knowledge assessment test- answers

There are a number of common mistakes or misconceptions that candidates make when taking the H&R Block Tax Knowledge Assessment Test. Some of the most common mistakes include:

- Not reading the question carefully and misunderstanding the key concepts being tested.

- Selecting an answer choice that is based on a common misconception or misunderstanding.

- Not considering the context of the question and the overall topic being tested.

- Selecting an answer choice that is too general or does not provide enough detail.

Sample Questions and Solutions

| Question | Answer | Explanation | Difficulty Level |

|---|---|---|---|

| Which of the following is a deductible expense for self-employed individuals? | Home office expenses | Home office expenses are deductible for self-employed individuals who use a portion of their home exclusively and regularly for business purposes. | Easy |

| What is the standard deduction for a single taxpayer in 2023? | $13,850 | The standard deduction is a specific amount that you can deduct from your taxable income before you calculate your taxes. | Medium |

| Which of the following is a tax credit? | Earned income tax credit | A tax credit is a dollar-for-dollar reduction in the amount of taxes you owe. | Hard |

Test-Taking Strategies

There are a number of strategies that you can use to prepare for and take the H&R Block Tax Knowledge Assessment Test. Here are some tips:

- Study the H&R Block Tax Knowledge Assessment Test Guide. This guide provides a comprehensive overview of the test and includes sample questions and answers.

- Take practice tests. There are a number of practice tests available online that can help you familiarize yourself with the format and content of the test.

- Manage your time wisely. The H&R Block Tax Knowledge Assessment Test is timed, so it is important to manage your time wisely. Read the questions carefully and allocate your time accordingly.

- Don’t guess. If you are not sure about the answer to a question, it is better to leave it blank than to guess.

Additional Information

The H&R Block Tax Knowledge Assessment Test is an important step in the hiring process for H&R Block. A passing score on the test demonstrates that you have the necessary tax knowledge and skills to be successful in a tax-related role.

For more information about the H&R Block Tax Knowledge Assessment Test, please visit the H&R Block website.

Quick FAQs: H&r Block Tax Knowledge Assessment Test- Answers

What is the purpose of the H&R Block Tax Knowledge Assessment Test?

The H&R Block Tax Knowledge Assessment Test is designed to evaluate the tax knowledge and skills of individuals seeking to work as tax professionals at H&R Block.

What is the format of the test?

The test consists of multiple-choice questions covering a range of tax topics, including individual income tax, business tax, and tax credits.

How can I prepare for the test?

To prepare for the test, it is recommended to review tax laws and regulations, practice answering multiple-choice questions, and utilize study materials provided by H&R Block.